Yongcheul Shin joins Orchid Group

Effective September 1, 2021, Mr. Yongcheul Shin joins Orchid Group

Effective September 1, 2021, Mr. Yongcheul Shin joins Orchid Group

Since the explosion of unconventional oil and gas production began

Back in January when the calendar flipped over from 2019

South Korea imported a record 44 million tons of LNG

Orchid Group was hired by a confidential client in China

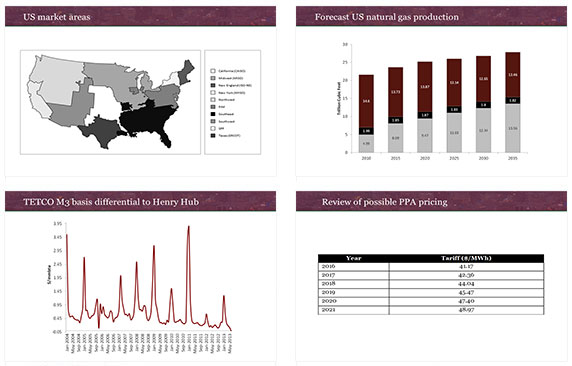

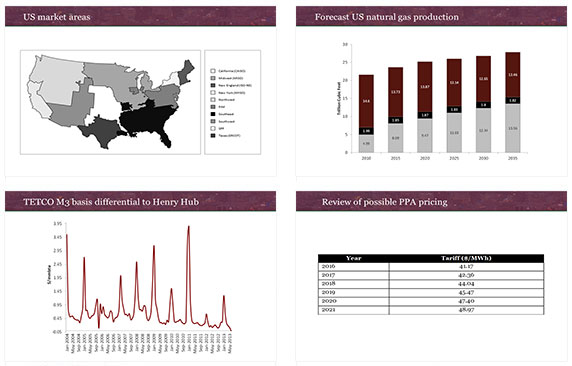

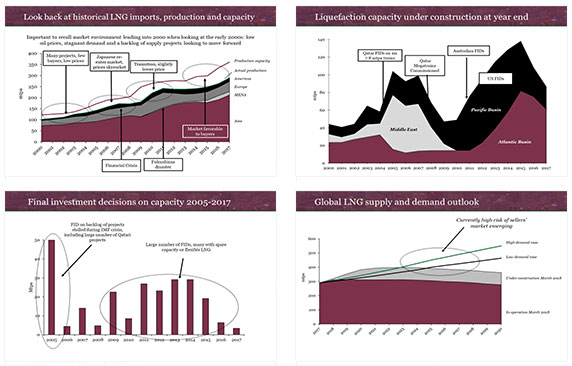

Since the explosion of unconventional oil and gas production began in 2013, the US has faced a new energy challenge: too much of everything. This has become increasingly true over time, particulary following the post-2015 low price cycle that temporarily slowed production

Back in January when the calendar flipped over from 2019 to 2020, the outlook for natural gas in the United States was extremely bearish. Continued growth in oil production in the Permian meant increasing volumes of gas flooding the market regardless of

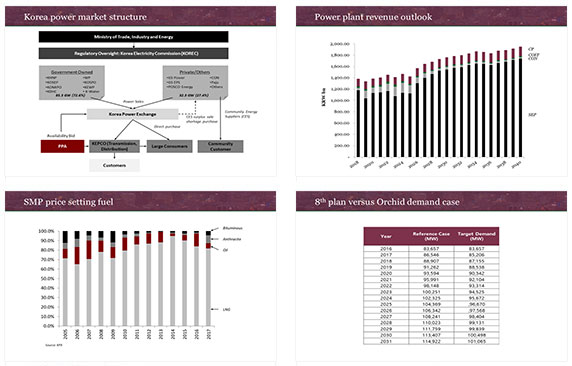

South Korea imported a record 44 million tons of LNG in 2018; a surprising 17.3% increase over 2017 imports. LNG consumption, not surprisingly, was also a record reaching 40.9 million tons, a 12.4% increase over 2017 demand and approximately 650 thousand tons

Orchid Group was hired by a confidential client in China to assess LNG projects in USA and Mexico for investment and off-take opportunities. The client is a significant owner and operator of natural gas and LNG infrastructure, including pipeline, distribution, and refueling

Thailand’s Electricity Generating Public Company Limited (“EGCO”) has closed the acquisition of a 49% stake in Paju Energy Service Co. (“Paju”), a power generation subsidiary of South Korea’s SK E&S – consisting of 1800 MW of combined cycle gas-fired power – for

Orchid Group is pleased to announce the formation of an affiliated law firm, Orchid Law. The combination of Orchid Group and Orchid Law allows us to offer clients a one-stop shop for commercial and legal advice. As part of our support of

Home / News & Insights

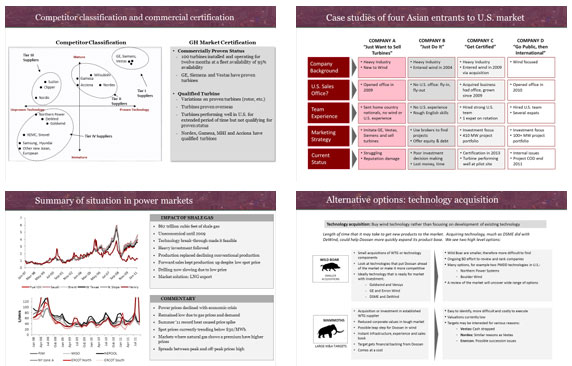

Background: Chinese wind turbine manufacturer, XEMC, approached Orchid to advise it on a brownfield wind power project in California that the firm was considering purchasing and re-powering with its own turbines.

Background: Korea South-East Power Co. (“KOSEP”) was considering the acquisition of a greenfield CCGT project in Pennsylvania within the PJM market and hired Korea Ratings (“KR”) to assess the feasibility of the project. On behalf of KOSEP, KR hired Orchid to lead due diligence from on the ground.

Background: The Electricity Generating Public Company Limited wished to bid on the sale of a 49% stake in an 1800 MW CCGT in South Korea and needed an adviser to forecast power market prices and advise on issues related to LNG supply agreements and a terminal use agreement.

Background: A confidential client was required by the lenders to two of its gas-fired power projects to demonstrate the competitiveness of its LNG supply agreements. Orchid Group was engaged to conduct the study.

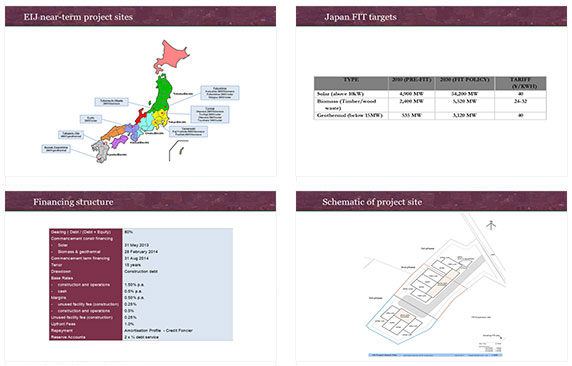

Background: Energy Initiative Japan (EIJ), a Japanese developer of solar projects hired Orchid to lead the sale of a portfolio of greenfield solar projects developed under the Feed-in-Tariff (FIT) established under the “Act on Special Measures Concerning the Procurement of Renewable Electrical Energy by Operators of Electric Utilities” in Japan.

Background: Doosan Heavy Industries (DHI) was eyeing the United States as their key market for selling wind turbines, but wanted to understand whether they could compete there, what models were most competitive the logistical network required for them to compete in the USA. They hired Orchid to help them work through developing market entry strategy.

Orchid provided DHI with a comprehensive package complete with strategic options for entering the USA.