Background: Chinese wind turbine manufacturer, XEMC, approached Orchid to advise it on a brownfield wind power project in California that the firm was considering purchasing and re-powering with its own turbines.

Background: Korea South-East Power Co. (“KOSEP”) was considering the acquisition of a greenfield CCGT project in Pennsylvania within the PJM market and hired Korea Ratings (“KR”) to assess the feasibility of the project. On behalf of KOSEP, KR hired Orchid to lead due diligence from on the ground.

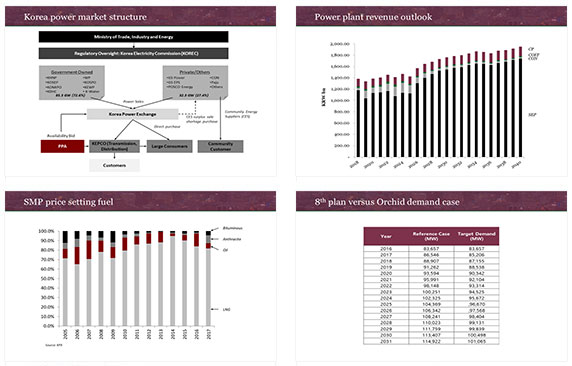

Background: The Electricity Generating Public Company Limited wished to bid on the sale of a 49% stake in an 1800 MW CCGT in South Korea and needed an adviser to forecast power market prices and advise on issues related to LNG supply agreements and a terminal use agreement.

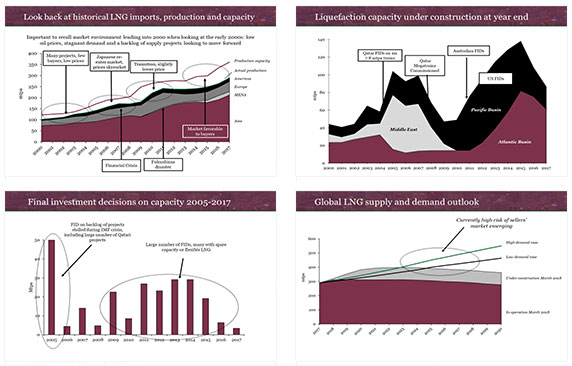

Background: A confidential client was required by the lenders to two of its gas-fired power projects to demonstrate the competitiveness of its LNG supply agreements. Orchid Group was engaged to conduct the study.

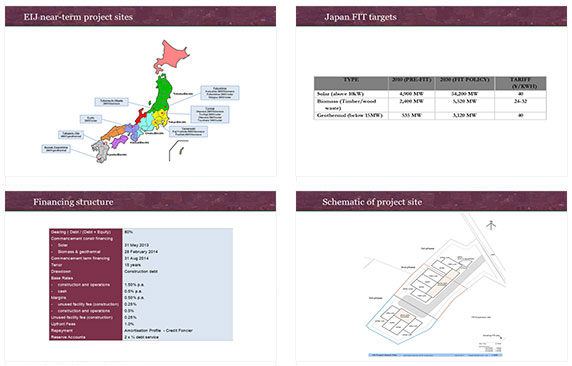

Background: Energy Initiative Japan (EIJ), a Japanese developer of solar projects hired Orchid to lead the sale of a portfolio of greenfield solar projects developed under the Feed-in-Tariff (FIT) established under the “Act on Special Measures Concerning the Procurement of Renewable Electrical Energy by Operators of Electric Utilities” in Japan.

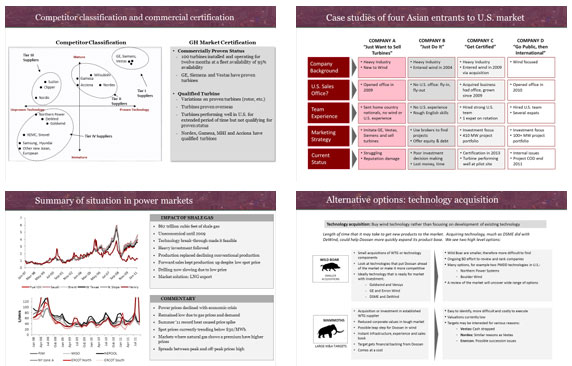

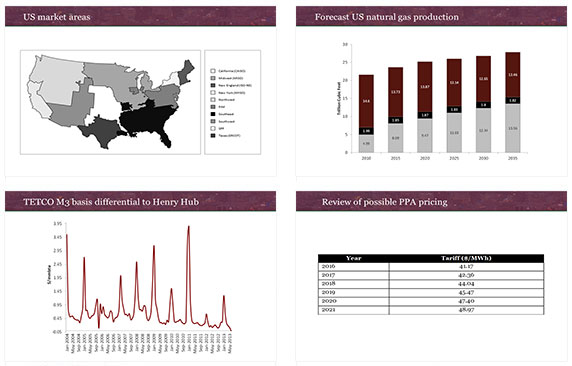

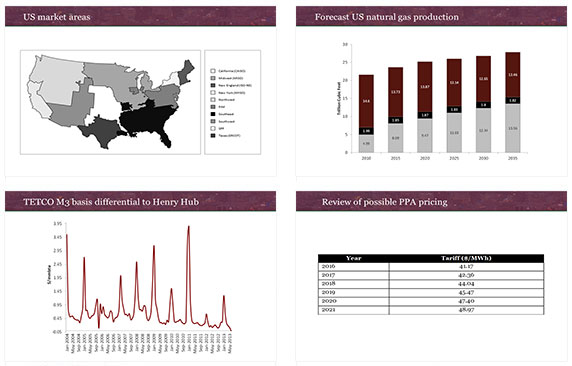

Background: Doosan Heavy Industries (DHI) was eyeing the United States as their key market for selling wind turbines, but wanted to understand whether they could compete there, what models were most competitive the logistical network required for them to compete in the USA. They hired Orchid to help them work through developing market entry strategy.

Orchid provided DHI with a comprehensive package complete with strategic options for entering the USA.